Bitcoin – Embracing Stability and Institutional Influence in Pursuit of Freedom

In recent times, Bitcoin has experienced its first down month since August of 2023. This decline can be attributed to various factors such as the slowdown in U.S. ETF inflows, the unwinding of the Greyscale Bitcoin Trust, and the minimal inflows from the Hong Kong ETF. The presence of Wall Street and global financial institutions in the Bitcoin market brings increased stability but also alters established buying and selling patterns.

Effect of Institutional Entries:

The entrance of institutional players into the Bitcoin market has already made a significant impact. The introduction of U.S. Bitcoin ETFs propelled BTC to an all-time high prior to the Halving, a historic milestone reached six months earlier than ever before. This unexpected development caught many investors off-guard. However, the current correction phase presents an opportunity for those who haven’t yet allocated to Bitcoin to scale into a position. To do this, I recommend using platforms like Strike, Fold, or setting up a recurring buy on your preferred exchange to practice Dollar-Cost Averaging (DCA). By purchasing small amounts daily, weekly, or monthly, you can gradually build your allocation over time.

Bitcoin Dominance and Altcoins:

Bitcoin dominance has risen significantly from 40% to 56%, leading to a decrease in the value and performance of even the strongest altcoins against BTC. This is a positive indication that the Bitcoin cycle is proceeding normally. I anticipate Bitcoin dominance to continue grinding higher and potentially reach a peak between 58% and 62%. It is worth noting that until this point, allocating to altcoins can be quite risky. Monitoring the Bitcoin dominance chart on platforms like Tradingview and devising a plan to allocate when dominance falls to 50% and below can significantly boost your overall Bitcoin holdings.

While April marked a down month for Bitcoin, the market’s association with institutions and the introduction of ETFs have paved the way for greater stability. This change in dynamics requires investors to adapt their strategies and take advantage of the correction phase to gradually allocate to Bitcoin. Understanding Bitcoin dominance and its relationship with altcoins can provide valuable insights into market trends and optimize your investment decisions. By embracing these developments while prioritizing personal freedom, individuals can navigate the evolving Bitcoin landscape and potentially reap substantial rewards.

https://www.coinglass.com/today

Introduction: Banking on Bitcoin

In light of recent developments, it is crucial to protect your wealth and property rights, especially considering the potential impacts of proposed legislation on self-custody and transactions involving cryptocurrencies. Senator Elizabeth Warren’s bill attempts to make self-custody illegal Bitcoin holders should explore alternative solutions to maintain control over their assets. This section aims to provide insights and suggestions to navigate the changing landscape while preserving financial autonomy.

Defending the Principles of Bitcoin:

Bitcoin was designed to empower individuals, freeing them from the economic constraints of fiat currency and the influence of banks and governments. The current attack on self-custody can be seen as a response from banks concerned about the threat to their dominance. Banks, along with government deficit spending, contribute to currency debasement, as loans create currency out of thin air and interest accrues based on this newly created money. Bitcoin’s scarcity and resilience make it an attractive safeguard against the devaluation of traditional currencies and the ideal asset for self-custody.

Becoming Your Own Bank:

Although spending Bitcoin directly in the United States remains challenging due to the IRS’s treatment of BTC as property with taxable implications, solutions are emerging. As a starting point, consider exchanging excess dollars for Bitcoin and securely storing it in a hard wallet, preferably a multisignature wallet. By doing so, you can access platforms that allow you to borrow against your Bitcoin holdings. Options such as Coinbase Loans and other centralized loan services offer potential avenues for leveraging your assets without tax implications. For those comfortable with decentralized finance (DeFi), platforms like Thorswap and Sovryn provide opportunities to borrow stablecoins against Bitcoin. These stablecoins can be spent by converting to USD on centralized exchanges or using services like Coinbase debit cards or Solana-based wallets like Phantom to make purchases at a growing number of global merchants using Stripe.

Exploring Global Opportunities:

Another strategy to consider is relocating to jurisdictions that have no capital gains tax or recognize Bitcoin as legal tender. Countries like El Salvador and the Central African Republic have already embraced Bitcoin as a legal currency, while Paraguay, Taiwan, and Palau are exploring similar initiatives. By taking advantage of friendlier regulatory environments, individuals can enjoy more favorable conditions for managing their Bitcoin investments.

Portability and Accessibility:

One of Bitcoin’s key strengths lies in its portability and the ability to access wealth with just a smartphone and an internet connection. This convenience sets it apart from assets like gold, silver, or large amounts of cash, which can attract unwanted attention and potential legal complications when traveling. While government regulations on cash and precious metals can be restrictive, Bitcoin offers the potential for seamless global access to your wealth, regardless of location or borders.

As the landscape surrounding self-custody and cryptocurrency transactions evolves, individuals must proactively safeguard their wealth and property rights. Understanding the principles of Bitcoin and exploring options like self-custody, borrowing against assets, and exploring favorable jurisdictions can provide essential protection and autonomy. Embracing Bitcoin’s portability and accessibility further enhances financial freedom, ensuring that one’s wealth remains secure and accessible worldwide. By staying informed and adaptable, individuals can navigate regulatory changes and preserve control

Government Crackdown Threatens Crypto Rights and Bitcoin Adoption Continues Behind the Scenes:

The US government’s recent actions highlight its ongoing interference with free markets and individual rights. The Securities and Exchange Commission (SEC) labeling Ethereum as an unlicensed security, despite approving Ethereum futures ETF traded on the CME as a commodity by the Commodity Futures Trading Commission (CFTC), is contradictory. Additionally, the arrest of Samurai Wallet developers and the removal of the app from app stores for being unlicensed money transmitters hampers self-custody options. This attempt to restrict self-custody wallets is concerning, as it could deem all such wallets unlicensed money transmitters.

Bank Restrictions on Crypto Exchanges:

Reports of banks closing accounts and imposing restrictions on the amount of money that can be sent to crypto exchanges have been increasing since the new year. Two notable incidents were shared on Twitter recently: one involving a long-term customer whose account was closed without explanation, and another where a customer was denied further transactions to a crypto exchange once the withdrawal limit had been reached. These actions are driven by the government’s covert pressure on banks to comply in order to avoid audits and potential account suspension. This concerted effort aims to stifle crypto investment by limiting the ability to transfer fiat currency to crypto exchanges. Ironically, the largest banks, which have influence over the Federal Reserve, are the ones shaping these regulations out of fear that Bitcoin and crypto pose a threat to their power and control.

Increasing Adoption Behind the Scenes:

Microstrategy’s successful Bitcoin accumulation strategy has inspired other companies to follow suit. For instance, a coal energy company recently announced that it had leveraged excess energy from its power plants to mine BTC, resulting in a balance sheet accumulation of 450 Bitcoin over the past year. Additionally, the first publicly traded Japanese company disclosed adding 5,000 Bitcoin to its balance sheet. It is likely that more public corporations will announce their inclusion of Bitcoin in their balance sheets as the year progresses. Microstrategy, with its peak gain exceeding 1000% since December 2022, currently holds 214,000 Bitcoin and is expected to be included in the S&P 500 Index by year-end.

Governments are also quietly accumulating Bitcoin, although specific holdings are not disclosed. El Salvador’s daily purchase of one Bitcoin and their plans to commence mining by the end of the year demonstrate their commitment. The Russian government’s involvement in building a massive dam in Africa to power a substantial Bitcoin mining operation further exemplifies this trend. Moreover, Paraguay, after briefly banning crypto mining, has reversed the ban and introduced legislation to establish Bitcoin as legal tender. Nigeria’s thriving Bitcoin economy persists despite the government’s unsuccessful attempts to enforce a central bank digital currency (CBDC) on its population.

Conclusion:

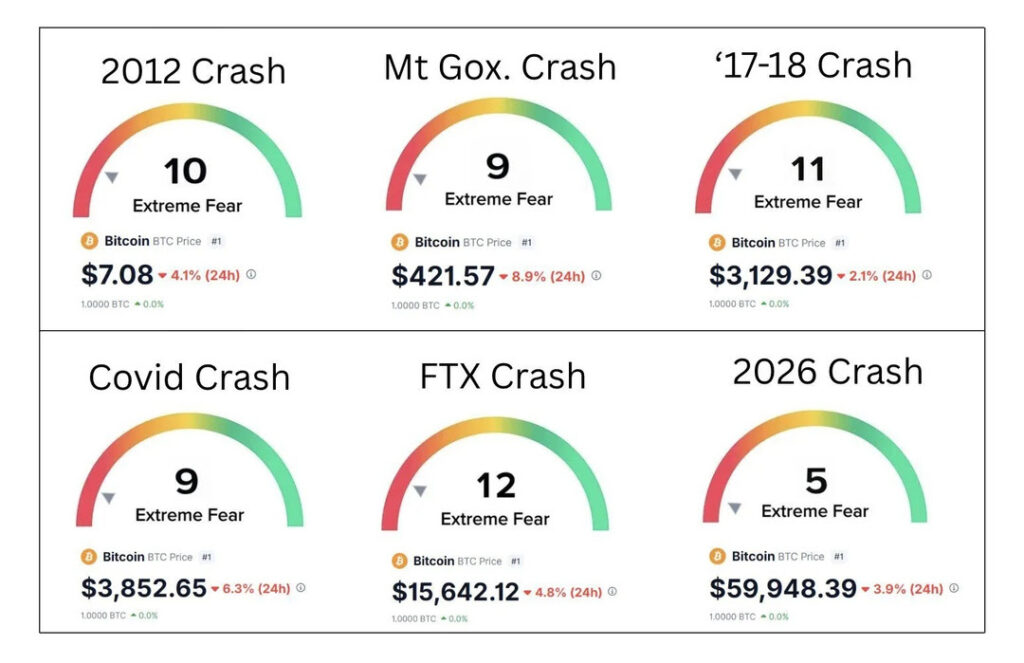

Bitcoin’s current correction, with typical market fluctuations of 20% to 40% during a bull run, presents an opportunity for those who have yet to accumulate Bitcoin. Comparably, a previous correction lasted 121 days, whereas the current correction has been ongoing for 51 days. Though it may continue until July or August, it would not be surprising if Bitcoin doesn’t reach a new all-time high until November. This period provides a chance to plan and accumulate Bitcoin through methods like dollar-cost averaging or setting limit orders to capitalize on price dips. As the Bitcoin cycle progresses to Phase 4, marked by the surpassing of the previous all-time high and steep price surges, it is crucial to develop strategies for maximizing profits from altcoins.

The desperate actions of both the government and banks should be of concern. Eliminating government spending would expose an economic recession, with the US GDP falling by -2% to -6% over the past six months when you remove government spending. The government is cooking the books in an attempt to convince people that the economy is in great shape and we are not in a recession. In other words, “Don’t believe your eyes”. Efforts to keep people within the system through manipulative practices, like the treasury’s plan to repurchase underwater bonds from banks, indicate their fear of a significant financial collapse resulting from a mass exodus from banks. This will only delay the inevitable and increase the likelihood of inflation remaining persistent, devaluing the dollar even faster. To protect oneself, storing wealth in Bitcoin and assuming custody of private keys becomes essential in these circumstances.

As always, it’s important to conduct your own research and this is not intended as financial advice.

Links & Tutorials

Bitcoin Education Resources

Hope.com – Learn more about Bitcoin and how to use BTC to protect your wealth.

The Bitcoin Standard – Book by Saifedean Ammous – a must-read!

The Bitcoin Way – Go bankless! Bitcoin education and services to help you custody your Bitcoin safely and securely.

Swan Bitcoin – Bitcoin exchange, IRAs and institutional-grade custody solutions

River Financial – Bitcoin exchange and institutional-grade custody solutions

Freedom People Resources

People Pay – Accept Bitcoin payments for your business

Chainrecorder – Prove ownership immutably by recording your documents on the Bitcoin blockchain

U.S. Regulated Exchanges (Fiat Onramps)

Coinbase – Using Coinbase Advance Video

Kraken – Using Kraken Pro Video

KYC Credentials Outside the U.S.

Palau ID – Foreign residence to pass KYC on foreign exchanges.

KYC Exchanges that Accept Palau ID (Must Use VPN – Costa Rica, Columbia, Mexico, Panama)

No KYC Exchanges (Must Use VPN – Costa Rica, Columbia, Mexico, Panama)

DEXs (Decentralized Exchanges) – Best Wallet To Use

Jupiter – Video Solana Ecosystem – Phantom Wallet

Whales Market – Solana OTC Trade Desk – Phantom Wallet

Thorswap – Swap native assets cross-chain (BTC for ETH etc..) and a very unique decentralized Bitcoin lending platform. Works best with the XDefi Browser Wallet.

Decentralized Bitcoin lending platform. Thorswap Overview Video Loans On Thorswap Video

Osmosis – Cosmos Ecosystem – Rabby, Metamask

Spooky Swap -Fantom – Rabby, Metamask

Trader Joe – Avalanche Ecosystem – Rabby, Metamask

Crypto Market and Portfolio Tracking

CoinGecko for portfolio tracking and up-to-date prices

CoinMarketCap – Crypto Prices

Banter Bubbles – Crypto Prices – Social Sentiment

Trading View – Chart all Markets and trading pairs Tradingview Tutorial Video

Storage – Not your keys, Not your crypto!

Cold Storage Wallets (Secure Long-Term Storage of Your Crypto)

Cold Card (Bitcoin Only) – Video

Hot Wallets (Lower Security – interact with DAPPS and Smart Contracts)

XDefi Browser Wallet – Video1 Video 2

Warning-If you have a wallet and an NFT has been sent to your wallet that you did not mint or purchase.. NEVER click on it. Many have malicious code that can drain your wallet! – BE CAREFUL

Stay Free!

Kury

Attachments area

Preview YouTube video Gemini Exchange Tutorial: Beginner Guide on How to Use Gemini to Buy Crypto

Gemini Exchange Tutorial: Beginner Guide on How to Use Gemini to Buy Crypto

Preview YouTube video Strike – Send Payments To Anyone In The World For Free (Full Tutorial)

Strike – Send Payments To Anyone In The World For Free (Full Tutorial)

Preview YouTube video The Fold Bitcoin Debit Card: Why NOT Using It Is ROBBING You Of Bitcoin

The Fold Bitcoin Debit Card: Why NOT Using It Is ROBBING You Of Bitcoin

Preview YouTube video KuCoin Tutorial For Beginners 2024 (COMPLETE GUIDE)

KuCoin Tutorial For Beginners 2024 (COMPLETE GUIDE)

Preview YouTube video Bitget Review & Tutorial: Beginner’s Guide on How to Use Bitget

Bitget Review & Tutorial: Beginner’s Guide on How to Use Bitget

Preview YouTube video How To Make Money In Crypto with Bybit! (Beginners Tutorial)

How To Make Money In Crypto with Bybit! (Beginners Tutorial)

Preview YouTube video Jupiter Exchange Guide (Solana DEFI Tutorial + $JUP??)

Jupiter Exchange Guide (Solana DEFI Tutorial + $JUP??)

Preview YouTube video How To Use ThorSwap On The THORChain (RUNE) Network!

How To Use ThorSwap On The THORChain (RUNE) Network!

Preview YouTube video 0% Interest Crypto Loan with ThorSwap

0% Interest Crypto Loan with ThorSwap

How to Use TradingView to Invest Full Time in Bitcoin & Crypto: Beginners Guide 2024

Preview YouTube video Trezor Safe 3 Setup Guide and Trezor Suite Tutorial

Trezor Safe 3 Setup Guide and Trezor Suite Tutorial

Best Crypto Wallet for Beginners Tangem Wallet 2024 Full Review (Watch First!) Step-by-Step

Preview YouTube video Ledger Nano X: Unboxing & Setup Beginner’s Guide 🧐

Ledger Nano X: Unboxing & Setup Beginner’s Guide

Preview YouTube video Coldcard Bitcoin Hardware Wallet – FULL TUTORIAL

Coldcard Bitcoin Hardware Wallet – FULL TUTORIAL

Preview YouTube video What Is TRUST WALLET? | Beginner’s Trust Wallet Tutorial In 2024

What Is TRUST WALLET? | Beginner’s Trust Wallet Tutorial In 2024

Preview YouTube video Trust Wallet Tutorial 2024 (How to Use Trust Wallet)

Trust Wallet Tutorial 2024 (How to Use Trust Wallet)

Coinbase Wallet Tutorial for Beginner 2024: How to Set-up & use Coinbase Wallet App & Extension

Preview YouTube video Rabby Wallet Tutorial (How to Setup & Use Rabby)

Rabby Wallet Tutorial (How to Setup & Use Rabby)

Preview YouTube video MetaMask: 2023 Beginner’s Guide & TOP Security Tips!

MetaMask: 2023 Beginner’s Guide & TOP Security Tips!

Preview YouTube video 🔥 XDEFI – The BEST Browser Extension Crypto Wallet

XDEFI – The BEST Browser Extension Crypto Wallet

Preview YouTube video How to Setup XDEFI Wallet for THORSwap (Tutorial)

How to Setup XDEFI Wallet for THORSwap (Tutorial)

Preview YouTube video How to Use Solana Phantom Wallet (Stake SOL, Send, Receive, Swap)

How to Use Solana Phantom Wallet (Stake SOL, Send, Receive, Swap)

You must be logged in to post a comment.